spcglider

Well-Known Member

- Joined

- Sep 15, 2004

- Messages

- 661

- Reaction score

- 3

Its a bit boring, but I'd say your first step might be drafting up a 3-5 year business plan. At least, the bank's gonna want to see one if you go to them for money... even if you've got collateral up the wahzzooo. And be optimistic. They like to think there'll be good returns within the first two or three years, even if that's completely unrealistic. Don't lie, but be optimistic. And have solid reasoning to back it up.

And have yourself an alternate plan in case the bank funding doesn't happen. Small business lending is completely screwball these days. No telling what their reasons may be for refusal. But don't let that stop you. Maybe you proceed at a slower pace than planned, but don't give it up if you don't want to.

-G

And have yourself an alternate plan in case the bank funding doesn't happen. Small business lending is completely screwball these days. No telling what their reasons may be for refusal. But don't let that stop you. Maybe you proceed at a slower pace than planned, but don't give it up if you don't want to.

-G

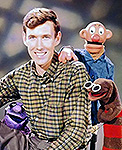

Welcome to the Muppet Central Forum!

Welcome to the Muppet Central Forum! The Muppet Show

The Muppet Show Sesame Street Classics on YouTube

Sesame Street Classics on YouTube Sesame Street debuts on Netflix

Sesame Street debuts on Netflix Back to the Rock Season 2

Back to the Rock Season 2 Sam and Friends Book

Sam and Friends Book Jim Henson Idea Man

Jim Henson Idea Man Bear arrives on Disney+

Bear arrives on Disney+