You may have been kidding, but it absolutely is research and you can write it off. I work as a writer in Hollywood and every movie I see is considered research. I have to know what is happening in the marketplace to be able to stay competitive.

Even if you weren't doing adult puppet shows, it would still be a deductible expense because you need to see what is successful. Maybe seeing it would inspire you to do an adult puppet show.

Anyway, I've been audited before and they argued with me that some of it has to be purely entertainment. I argued that while I may be entertained as a consequence, it's still a business expense because I have to see current entertainment to stay relevant in the marketplace. I won the argument and my deductions were allowed. The only one they disallowed was the daily newspaper, saying it was just too generic to be relevant. Now, if I had been writing jokes for Jay Leno, I would have argued that one, too.

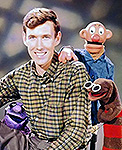

Welcome to the Muppet Central Forum!

Welcome to the Muppet Central Forum!

The Muppet Show

The Muppet Show

Sesame Street Classics on YouTube

Sesame Street Classics on YouTube

Sesame Street debuts on Netflix

Sesame Street debuts on Netflix

Back to the Rock Season 2

Back to the Rock Season 2

Sam and Friends Book

Sam and Friends Book

Jim Henson Idea Man

Jim Henson Idea Man

Bear arrives on Disney+

Bear arrives on Disney+

waldorf wake up!

waldorf wake up!