Here's the full text in case anyone has trouble seeing the article...

Disney set to bid for Muppets

Courtesy of Reuters

December 18, 2002

Mickey Mouse and Kermit the Frog could soon be new best friends.

Walt Disney Co. is preparing to offer about $135 million for Jim Henson Co., a bid that likely would position it to win the assets of the renowned Muppet maker more than a decade after it walked away from the chance, according to people familiar with the situation.

Although Disney's bid would be a steep discount from the $680 million German children's programming giant EM.TV paid for Henson in March 2000, it is still far too rich a price, people familiar with Henson's assets said. They put the value at no more than $80 million.

Four other suitors also are considering bids for the creators of such famed puppet characters as Miss Piggy and Big Bird, but none is likely to pay as much as Burbank, California-based Disney, sources say.

"EM.TV is in parallel talks with several parties and this means more than two," said an EM.TV spokesman in Munich, who declined to comment about specific bidders. A Henson spokesman in New York also declined to comment.

A Disney spokesman said the company as a matter of policy does not comment on speculation regarding acquisitions.

Henson's business includes the rights to its world renowned Muppets characters, the Creature Shop that creates special effects for movies, and about 650 hours of programming.

Under EM.TV's ownership Henson divested its stake in Crown Media Holdings Inc. for $100 million and sold the Sesame Street Muppets characters to the Sesame Workshop for $180 million.

Sesame Workshop still owes about $70 million on the deal, which is to be paid over time, giving Henson a steady cashflow stream, people familiar with that agreement said. However, some of the licensing arrangements at Henson are messy, the company's staff is bloated and it needs an infusion of capital to restore the brand to its former glory, sources said.

Critics say Disney pays too high a premium on its acquisitions. While that idea can be debated, the company is widely seen by analysts to have overpaid for Fox Family Worldwide last year, for which it spent $5.2 billion, including $2.2 billion of debt. Earlier this year, Disney cut about half the workforce at renamed ABC Family.

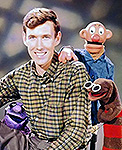

Disney, which already has some partnership arrangements with Henson, was set to buy the company in 1990, but when namesake Jim Henson died suddenly, it pulled out of the deal. Henson's son, Brian, took over the empire founded in 1958.

EM.TV, which has been shopping Henson for more than a year, had been looking to close a deal soon to cover a 64 million euro ($66 million) loan due at year's end.

The company could, however, get an extension from its lenders, who are being apprised of the Henson auction, and push the sale into the first quarter of 2003, sources said.

According to people familiar with the situation, the other four parties mulling bids for Henson are London-based Entertainment Rights; privately held Classic Media; billionaire investor Haim Saban; and Dean Valentine, the former chief executive of United Paramount Network.

None could be reached for comment.

Welcome to the Muppet Central Forum!

Welcome to the Muppet Central Forum!

Jim Henson Idea Man

Jim Henson Idea Man

Back to the Rock Season 2

Back to the Rock Season 2

Bear arrives on Disney+

Bear arrives on Disney+

Sam and Friends Book

Sam and Friends Book