Chad Kermit

Well-Known Member

- Joined

- Apr 19, 2002

- Messages

- 104

- Reaction score

- 0

At least 3 contending for Henson

Mouse House considered prohibitive favorite

By CARL DIORIO

Bankers running EM.TV's auction of the Jim Henson Co. continue to refuse Haim Saban the opportunity for exclusive negotiations to buy the famed family entertainment outfit, instead inking separate letters of intent with three prospective buyers.

EM.TV needs to conclude the auction within the next few weeks to help the German media company meet a big loan payment that comes due at year's end. So the heat is on for blue-chip investment firm Allen & Co. to wrap up talks with one of the parties soon.

Three offers have been received ranging between $125 million and $150 million. Saban and the entertainment financier's partners at investment firm Evercore placed one of the three bids, another comes from an unspecified children's producer in the U.K., and a third has been placed by another unspecified party; Disney is still sitting out the auction.

Many bet on Mouse

The Mouse House had been considered a prohibitive favorite to adopt Kermit and his Muppet brethren at Henson into the Magic Kingdom, but so far the studio seems too preoccupied with fixing its existing operations to pursue additional assets. Yet a key source noted at least one other bid could still be in the offing from a party other than Disney, so there's no reason Allen wouldn't let the Mouse place a last-minute offer as well.

"Disney has never specifically said no (to placing an offer) and continues to lurk in the wings," the source said. "It's one of those companies that can come in and surprise you at the last moment."

Disney must move fast

Indeed, Disney execs must have been chagrined that recent Muppets telefilm "It's a Very, Merry Muppets Christmas" brought ratings benefits to NBC and not Mouse's Alphabet. But conglom would have to move fast, as any of the three existing bids could well pass muster with EM.TV.

"All of them are good enough for the seller, though they all have different prices," a source suggested. "For now, they're essentially closing on all of the (prospective) deals at the same time."

It appears Henson management has decided against pursuing its own bid for the onetime family-owned company. But it's believed key execs are involved in at least three of the scenarios taking shape, with none of the suitors aiming to liquidate the company.

A source close to the process said one or more of the potential auction winners would allow EM to completely cash out, while at least one proposal involves a partial equity buy by a company seeking good strategic fit between Henson's operations and its own existing operations.

Mouse House considered prohibitive favorite

By CARL DIORIO

Bankers running EM.TV's auction of the Jim Henson Co. continue to refuse Haim Saban the opportunity for exclusive negotiations to buy the famed family entertainment outfit, instead inking separate letters of intent with three prospective buyers.

EM.TV needs to conclude the auction within the next few weeks to help the German media company meet a big loan payment that comes due at year's end. So the heat is on for blue-chip investment firm Allen & Co. to wrap up talks with one of the parties soon.

Three offers have been received ranging between $125 million and $150 million. Saban and the entertainment financier's partners at investment firm Evercore placed one of the three bids, another comes from an unspecified children's producer in the U.K., and a third has been placed by another unspecified party; Disney is still sitting out the auction.

Many bet on Mouse

The Mouse House had been considered a prohibitive favorite to adopt Kermit and his Muppet brethren at Henson into the Magic Kingdom, but so far the studio seems too preoccupied with fixing its existing operations to pursue additional assets. Yet a key source noted at least one other bid could still be in the offing from a party other than Disney, so there's no reason Allen wouldn't let the Mouse place a last-minute offer as well.

"Disney has never specifically said no (to placing an offer) and continues to lurk in the wings," the source said. "It's one of those companies that can come in and surprise you at the last moment."

Disney must move fast

Indeed, Disney execs must have been chagrined that recent Muppets telefilm "It's a Very, Merry Muppets Christmas" brought ratings benefits to NBC and not Mouse's Alphabet. But conglom would have to move fast, as any of the three existing bids could well pass muster with EM.TV.

"All of them are good enough for the seller, though they all have different prices," a source suggested. "For now, they're essentially closing on all of the (prospective) deals at the same time."

It appears Henson management has decided against pursuing its own bid for the onetime family-owned company. But it's believed key execs are involved in at least three of the scenarios taking shape, with none of the suitors aiming to liquidate the company.

A source close to the process said one or more of the potential auction winners would allow EM to completely cash out, while at least one proposal involves a partial equity buy by a company seeking good strategic fit between Henson's operations and its own existing operations.

Welcome to the Muppet Central Forum!

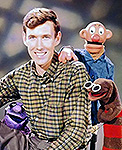

Welcome to the Muppet Central Forum! Jim Henson Idea Man

Jim Henson Idea Man Back to the Rock Season 2

Back to the Rock Season 2 Bear arrives on Disney+

Bear arrives on Disney+ Sam and Friends Book

Sam and Friends Book

* and thank him for proving me wrong.

* and thank him for proving me wrong.