- Joined

- Apr 11, 2002

- Messages

- 8,293

- Reaction score

- 3,425

Trial of TV brothers puts culture in dock

Courtesy of The Guardian

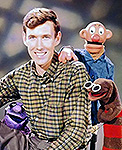

For one investor in EM.TV, what's left is a plastic Kermit the Frog. Today the saga reaches court.

Two brothers are due to appear in the dock of a Munich court today at the start of what many see as a trial of Germany's fledgling equity culture.

Thomas and Florian Haffa oversaw one of the extraordinary boom-to-bust stories of recent years. Between 1997 and 2000, shares in their firm, EM.TV, rose 20,000% to a peak at which the company was worth more to the stock market than Lufthansa. Then they tilted into a crash that, within less than a year, had cost investors more than £5bn.

In the first case of its kind in Germany, the two brothers stand accused of misleading their shareholders as to the true value of an enterprise which owns the Muppet show and a stake in Formula One motor racing. If found guilty, they face up to three years in jail or a fine as much as £1m.

As a cautionary tale of financial life, it could scarcely be bettered. On one side, there is the perma-tanned, 50-year-old Thomas, a former salesman renowned as much for the glittering parties he threw aboard his 115-foot yacht as for his supposed financial genius.

On the other side, those like Renate Allgaier, aged 57, a part-time secretary from Ottobrun near Munich, who ploughed her entire personal savings into EM.TV.

"I've lost 15,000 marks (almost £5,000). I feel tricked," she said.

Or those such as Jörg Bortenschlager, 27, from Geisenfeld, also in Bavaria, who describes himself as an "ex-millionaire". "All I have left from EM.TV are promotional gifts like [my plastic model of] Kermit the Frog," he told the Sunday tabloid Bild am Sonntag.

After the crash, some 500 shareholders banded together to press for compensation before their cause was taken up by the state. While the story of EM.TV has much to say about the inadequate oversight of Frankfurt's now-defunct Neue Markt, it has also shown up an awesome degree of reckless innocence in a country where bonds, rather than shares, were until recently the security of preference for small investors.

The charges laid by the state go back to September 2000 when EM.TV reported wildly inaccurate figures. When they were corrected the following month, Florian, now 37, resigned as chief financial executive.

Three months later, the company disclosed debts of almost £800m in a shock profit warning.

The Haffas' lawyers are expected to argue that EM.TV's stock market valuation had fallen sharply even before September 2000.

At the root of the company's problems is the shopping spree in which Thomas netted the Jim Henson company, owner of the Muppets, and a half-share in Bernie Ecclestone's Formula One holding.

The prices paid were stratospheric. But then the purchases were funded, in large part, with EM.TV's own astronomically-priced shares.

Thomas, who still owns 17.5 per cent of EM.TV resigned as chief executive officer in the summer of 2001.

http://www.guardian.co.uk/business/story/0,3604,825375,00.html

Courtesy of The Guardian

For one investor in EM.TV, what's left is a plastic Kermit the Frog. Today the saga reaches court.

Two brothers are due to appear in the dock of a Munich court today at the start of what many see as a trial of Germany's fledgling equity culture.

Thomas and Florian Haffa oversaw one of the extraordinary boom-to-bust stories of recent years. Between 1997 and 2000, shares in their firm, EM.TV, rose 20,000% to a peak at which the company was worth more to the stock market than Lufthansa. Then they tilted into a crash that, within less than a year, had cost investors more than £5bn.

In the first case of its kind in Germany, the two brothers stand accused of misleading their shareholders as to the true value of an enterprise which owns the Muppet show and a stake in Formula One motor racing. If found guilty, they face up to three years in jail or a fine as much as £1m.

As a cautionary tale of financial life, it could scarcely be bettered. On one side, there is the perma-tanned, 50-year-old Thomas, a former salesman renowned as much for the glittering parties he threw aboard his 115-foot yacht as for his supposed financial genius.

On the other side, those like Renate Allgaier, aged 57, a part-time secretary from Ottobrun near Munich, who ploughed her entire personal savings into EM.TV.

"I've lost 15,000 marks (almost £5,000). I feel tricked," she said.

Or those such as Jörg Bortenschlager, 27, from Geisenfeld, also in Bavaria, who describes himself as an "ex-millionaire". "All I have left from EM.TV are promotional gifts like [my plastic model of] Kermit the Frog," he told the Sunday tabloid Bild am Sonntag.

After the crash, some 500 shareholders banded together to press for compensation before their cause was taken up by the state. While the story of EM.TV has much to say about the inadequate oversight of Frankfurt's now-defunct Neue Markt, it has also shown up an awesome degree of reckless innocence in a country where bonds, rather than shares, were until recently the security of preference for small investors.

The charges laid by the state go back to September 2000 when EM.TV reported wildly inaccurate figures. When they were corrected the following month, Florian, now 37, resigned as chief financial executive.

Three months later, the company disclosed debts of almost £800m in a shock profit warning.

The Haffas' lawyers are expected to argue that EM.TV's stock market valuation had fallen sharply even before September 2000.

At the root of the company's problems is the shopping spree in which Thomas netted the Jim Henson company, owner of the Muppets, and a half-share in Bernie Ecclestone's Formula One holding.

The prices paid were stratospheric. But then the purchases were funded, in large part, with EM.TV's own astronomically-priced shares.

Thomas, who still owns 17.5 per cent of EM.TV resigned as chief executive officer in the summer of 2001.

http://www.guardian.co.uk/business/story/0,3604,825375,00.html

Welcome to the Muppet Central Forum!

Welcome to the Muppet Central Forum! Jim Henson Idea Man

Jim Henson Idea Man Back to the Rock Season 2

Back to the Rock Season 2 Bear arrives on Disney+

Bear arrives on Disney+ Sam and Friends Book

Sam and Friends Book